Winning the loser's game

Re: Winning the loser's game

Fiz um pequeno edit, porque me tinha enganado logo no início na parte dos dividendos

(queria evitar ETFs que distribuam dividendos e não os que capitalizem

(queria evitar ETFs que distribuam dividendos e não os que capitalizem  ).

).

Relativamente a um ETF europeu que replique, por exemplo, o S&P500 e capitalize dividendos, encontra-se por exemplo o "DB x-Trackers S&P 500 UCITS ETF 3C (EUR hedged)"

O problema é encontrar um ETF Europeu que replique o Vanguard VEU/VXUS. Não encontrei nada, razão pela qual preferi replicar a carteira doutra forma (Europeu e Ex-Europeu) e mesmo assim só encontrei aquele ETF sintético da Amundi

Podes, claro, diminuir a % da carteira europeia e aumentar a % da carteira extra-europeia, para aumentar a exposição a acções americanas. As % são um mero exemplo e não devem ser consideradas como verdade absoluta.

Obrigado pelos comentários.

(queria evitar ETFs que distribuam dividendos e não os que capitalizem

(queria evitar ETFs que distribuam dividendos e não os que capitalizem Relativamente a um ETF europeu que replique, por exemplo, o S&P500 e capitalize dividendos, encontra-se por exemplo o "DB x-Trackers S&P 500 UCITS ETF 3C (EUR hedged)"

O problema é encontrar um ETF Europeu que replique o Vanguard VEU/VXUS. Não encontrei nada, razão pela qual preferi replicar a carteira doutra forma (Europeu e Ex-Europeu) e mesmo assim só encontrei aquele ETF sintético da Amundi

Podes, claro, diminuir a % da carteira europeia e aumentar a % da carteira extra-europeia, para aumentar a exposição a acções americanas. As % são um mero exemplo e não devem ser consideradas como verdade absoluta.

Obrigado pelos comentários.

- Mensagens: 379

- Registado: 13/9/2013 0:16

Re: Winning the loser's game

mwc 2.0 Escreveu:Bom dia Mouro_Emprestado,

Desde já, agradeço o pertinência do teu "post".

Analisando, os ETF em euros não são totalmente comparáveis aos ETF em dólares, nomeadamente no que diz respeito às acções. Basicamente, ficarias exposto a 50% em acções europeias e os restantes 50% em acções internacionais.

genericamente, 50% capitalização bolsista global corresponde ao mercado norte americano. Seria preferível usar um ETF que replique os índices norte americanos (S&P 500, pex.) e aumentar a exposição aos USA.

Claro que não sei será fácil encontrar um ETF em Euros que replique algum índice dos USA.

Cumprimentos,

MWC 2.0 (ex-MWC)

É menos complicado do que imagina. Já há umas páginas atrás coloquei a minha carteira alternativa que tentava replicar a do LTCM em euros e com capitalização de dividendos. Dentro das small caps USA, temos o iShares MSCI USA Small Cap UCITS ETF, com versões em $ e €.

Para um mais geral, há também o iShares MSCI USA B, que também pode ser negociado em €.

Re: Winning the loser's game

Mouro_Emprestado Escreveu:Na minha demanda para tentar replicar a carteira de 4 Fundos do Rick Ferri para um investidor Europeu, evitando ETFs que capitalizem dividendos, deixo abaixo uma sugestão (outras, claro, existirão):

Obrigações (30%):

Para os investidores americanos, é sugerido investir no “Vanguard BND” (Vanguard Total Bond Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 6000 obrigações, das quais 65% corresponde a Títulos de Tesouro dos EUA;

A duração média da carteira é de 5 anos e meio;

Tem uma dividend-yeld de 2,17% e distribui dividendos todos os meses (auch!);

O custo anual deste ETF é de 0,08%.

Tive problemas em encontrar um ETF semelhante que fosse suficientemente líquido e acabei por não encontrar nenhum fundo que capitalizasse dividendos.

O único que me pareceu mais razoável é o “iShares Euro Aggregate Bond UCITS ETF” (ISIN: IE00B3DKXQ41), destacando o seguinte:

Carteira constituída por mais de 1000 obrigações, dos quais a maioria corresponde a obrigações emitidas pelos Estados;

A duração média da carteira é ligeiramente superior a 7 anos;

Tem uma dividend-yeld de 2,22% e distribui dividendos semestralmente (menos mal, por causa das comissões);

Replica directamente o índice;

O custo anual deste ETF é de 0,25%.

Alternativamente, pode-se tentar procurar um Fundo de Investimento de Gestão Activa (FIGA) que vá capitalizando dividendos. Pessoalmente, vou usando o “Legg Mason Global Funds PLC - Legg Mason Brandywine Global Fixed Income Fund”, ainda que seja um estilo de obrigações diferentes.

Acções Domésticas (30%):

Para os investidores americanos, é sugerido investir no “Vanguard VTI” (Vanguard Total Stock Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 3500 acções americanas (assim inclui também empresas mid-cap e small-cap);

Tem uma dividend-yeld de 1,86% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,05%.

No que respeita a ETFs Europeus, o mais global que é encontrei é o “db x-trackers Stoxx Europe 600 UCITS ETF DR” (ISIN: LU0328475792), destacando o seguinte:

Carteira constituída por cerca de 600 obrigações das maiores empresas europeias;[/li]

Não distribui dividendos;

Replica directamente o índice;

O custo anual deste ETF é de 0,14%.

Acções não Domésticas (30%):

Para os investidores americanos, é sugerido investir no “Vanguard VXUS” (Vanguard Total International Stock Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 5500 acções mundiais (excluindo acções americanas);

Tem uma dividend-yeld de 3,11% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,14%.

No que respeita a ETFs Europeus, apenas encontrei um que aposta num índice accionista sem acções europeias: “AMUNDI ETF MSCI WORLD EX EUROPE UCITS ETF – EUR” (ISIN: FR0010756122).

Resumidamente, destaco o seguinte deste ETF:

É um ETF completamente sintético, pelo que não detém posições físicas (sinceramente, não é do meu agrado);

Como é um ETF sintético, não distribui dividendos;

O custo anual deste ETF é de 0,35%.

Real Estate (10%):

Para os investidores americanos, é sugerido investir no “Vanguard VNQ” (Vanguard REIT).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por cerca de 130 acções americanas;

Tem uma dividend-yeld de 3,69% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,10%.

No que respeita a ETFs Europeus, destaco o “db x-trackers FTSE EPRA/NAREIT Developed Europe Real Estate UCITS ETF DR – 1C” (ISIN: LU0489337690).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por cerca de 90 acções europeias;

Não distribui dividendos;

Replica directamente o índice;

O custo anual deste ETF é de 0,40%.

O próximo passo a tentar fazer um backtest e comparar com a carteira americana.

Agradeço sugestões e comentários

Disclaimer: Não me responsabilizo por tentarem replicar o investimento acima sugerido. Quem o fizer, está por sua conta e risco.

Bom dia Mouro_Emprestado,

Desde já, agradeço o pertinência do teu "post".

Analisando, os ETF em euros não são totalmente comparáveis aos ETF em dólares, nomeadamente no que diz respeito às acções. Basicamente, ficarias exposto a 50% em acções europeias e os restantes 50% em acções internacionais.

genericamente, 50% capitalização bolsista global corresponde ao mercado norte americano. Seria preferível usar um ETF que replique os índices norte americanos (S&P 500, pex.) e aumentar a exposição aos USA.

Claro que não sei será fácil encontrar um ETF em Euros que replique algum índice dos USA.

Cumprimentos,

MWC 2.0 (ex-MWC)

"The truth has no temperature" - Malika in "The Counselor"

- Mensagens: 54

- Registado: 2/5/2014 7:58

Re: Winning the loser's game

obg mouro pela análise

penso que a real mais valia em escolher ETF europeus é que estes são cotados em €, eliminando assim o risco cambial.

Pena que continuem a haver poucos.

Será interessante analisar os resultados desse backtest. eu quando faço, faço aqui http://www.etfreplay.com/combine.aspx

penso que a real mais valia em escolher ETF europeus é que estes são cotados em €, eliminando assim o risco cambial.

Pena que continuem a haver poucos.

Será interessante analisar os resultados desse backtest. eu quando faço, faço aqui http://www.etfreplay.com/combine.aspx

- Mensagens: 39

- Registado: 30/3/2011 17:37

- Localização: 14

Re: Winning the loser's game

Na minha demanda para tentar replicar a carteira de 4 Fundos do Rick Ferri para um investidor Europeu, evitando ETFs que distribuam dividendos, deixo abaixo uma sugestão (outras, claro, existirão):

Obrigações (30%):

Para os investidores americanos, é sugerido investir no “Vanguard BND” (Vanguard Total Bond Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 6000 obrigações, das quais 65% corresponde a Títulos de Tesouro dos EUA;

A duração média da carteira é de 5 anos e meio;

Tem uma dividend-yeld de 2,17% e distribui dividendos todos os meses (auch!);

O custo anual deste ETF é de 0,08%.

Tive problemas em encontrar um ETF semelhante que fosse suficientemente líquido e acabei por não encontrar nenhum fundo que capitalizasse dividendos.

O único que me pareceu mais razoável é o “iShares Euro Aggregate Bond UCITS ETF” (ISIN: IE00B3DKXQ41), destacando o seguinte:

Carteira constituída por mais de 1000 obrigações, dos quais a maioria corresponde a obrigações emitidas pelos Estados;

A duração média da carteira é ligeiramente superior a 7 anos;

Tem uma dividend-yeld de 2,22% e distribui dividendos semestralmente (menos mal, por causa das comissões);

Replica directamente o índice;

O custo anual deste ETF é de 0,25%.

Alternativamente, pode-se tentar procurar um Fundo de Investimento de Gestão Activa (FIGA) que vá capitalizando dividendos. Pessoalmente, vou usando o “Legg Mason Global Funds PLC - Legg Mason Brandywine Global Fixed Income Fund”, ainda que seja um estilo de obrigações diferentes.

Acções Domésticas (30%):

Para os investidores americanos, é sugerido investir no “Vanguard VTI” (Vanguard Total Stock Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 3500 acções americanas (assim inclui também empresas mid-cap e small-cap);

Tem uma dividend-yeld de 1,86% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,05%.

No que respeita a ETFs Europeus, o mais global que é encontrei é o “db x-trackers Stoxx Europe 600 UCITS ETF DR” (ISIN: LU0328475792), destacando o seguinte:

Carteira constituída por cerca de 600 obrigações das maiores empresas europeias;[/li]

Não distribui dividendos;

Replica directamente o índice;

O custo anual deste ETF é de 0,14%.

Acções não Domésticas (30%):

Para os investidores americanos, é sugerido investir no “Vanguard VXUS” (Vanguard Total International Stock Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 5500 acções mundiais (excluindo acções americanas);

Tem uma dividend-yeld de 3,11% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,14%.

No que respeita a ETFs Europeus, apenas encontrei um que aposta num índice accionista sem acções europeias: “AMUNDI ETF MSCI WORLD EX EUROPE UCITS ETF – EUR” (ISIN: FR0010756122).

Resumidamente, destaco o seguinte deste ETF:

É um ETF completamente sintético, pelo que não detém posições físicas (sinceramente, não é do meu agrado);

Como é um ETF sintético, não distribui dividendos;

O custo anual deste ETF é de 0,35%.

Real Estate (10%):

Para os investidores americanos, é sugerido investir no “Vanguard VNQ” (Vanguard REIT).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por cerca de 130 acções americanas;

Tem uma dividend-yeld de 3,69% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,10%.

No que respeita a ETFs Europeus, destaco o “db x-trackers FTSE EPRA/NAREIT Developed Europe Real Estate UCITS ETF DR – 1C” (ISIN: LU0489337690).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por cerca de 90 acções europeias;

Não distribui dividendos;

Replica directamente o índice;

O custo anual deste ETF é de 0,40%.

O próximo passo a tentar fazer um backtest e comparar com a carteira americana.

Agradeço sugestões e comentários

Disclaimer: Não me responsabilizo por tentarem replicar o investimento acima sugerido. Quem o fizer, está por sua conta e risco.

Obrigações (30%):

Para os investidores americanos, é sugerido investir no “Vanguard BND” (Vanguard Total Bond Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 6000 obrigações, das quais 65% corresponde a Títulos de Tesouro dos EUA;

A duração média da carteira é de 5 anos e meio;

Tem uma dividend-yeld de 2,17% e distribui dividendos todos os meses (auch!);

O custo anual deste ETF é de 0,08%.

Tive problemas em encontrar um ETF semelhante que fosse suficientemente líquido e acabei por não encontrar nenhum fundo que capitalizasse dividendos.

O único que me pareceu mais razoável é o “iShares Euro Aggregate Bond UCITS ETF” (ISIN: IE00B3DKXQ41), destacando o seguinte:

Carteira constituída por mais de 1000 obrigações, dos quais a maioria corresponde a obrigações emitidas pelos Estados;

A duração média da carteira é ligeiramente superior a 7 anos;

Tem uma dividend-yeld de 2,22% e distribui dividendos semestralmente (menos mal, por causa das comissões);

Replica directamente o índice;

O custo anual deste ETF é de 0,25%.

Alternativamente, pode-se tentar procurar um Fundo de Investimento de Gestão Activa (FIGA) que vá capitalizando dividendos. Pessoalmente, vou usando o “Legg Mason Global Funds PLC - Legg Mason Brandywine Global Fixed Income Fund”, ainda que seja um estilo de obrigações diferentes.

Acções Domésticas (30%):

Para os investidores americanos, é sugerido investir no “Vanguard VTI” (Vanguard Total Stock Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 3500 acções americanas (assim inclui também empresas mid-cap e small-cap);

Tem uma dividend-yeld de 1,86% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,05%.

No que respeita a ETFs Europeus, o mais global que é encontrei é o “db x-trackers Stoxx Europe 600 UCITS ETF DR” (ISIN: LU0328475792), destacando o seguinte:

Carteira constituída por cerca de 600 obrigações das maiores empresas europeias;[/li]

Não distribui dividendos;

Replica directamente o índice;

O custo anual deste ETF é de 0,14%.

Acções não Domésticas (30%):

Para os investidores americanos, é sugerido investir no “Vanguard VXUS” (Vanguard Total International Stock Market).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por mais de 5500 acções mundiais (excluindo acções americanas);

Tem uma dividend-yeld de 3,11% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,14%.

No que respeita a ETFs Europeus, apenas encontrei um que aposta num índice accionista sem acções europeias: “AMUNDI ETF MSCI WORLD EX EUROPE UCITS ETF – EUR” (ISIN: FR0010756122).

Resumidamente, destaco o seguinte deste ETF:

É um ETF completamente sintético, pelo que não detém posições físicas (sinceramente, não é do meu agrado);

Como é um ETF sintético, não distribui dividendos;

O custo anual deste ETF é de 0,35%.

Real Estate (10%):

Para os investidores americanos, é sugerido investir no “Vanguard VNQ” (Vanguard REIT).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por cerca de 130 acções americanas;

Tem uma dividend-yeld de 3,69% e distribui dividendos trimestralmente;

O custo anual deste ETF é de 0,10%.

No que respeita a ETFs Europeus, destaco o “db x-trackers FTSE EPRA/NAREIT Developed Europe Real Estate UCITS ETF DR – 1C” (ISIN: LU0489337690).

Resumidamente, destaco o seguinte deste ETF:

Carteira constituída por cerca de 90 acções europeias;

Não distribui dividendos;

Replica directamente o índice;

O custo anual deste ETF é de 0,40%.

O próximo passo a tentar fazer um backtest e comparar com a carteira americana.

Agradeço sugestões e comentários

Disclaimer: Não me responsabilizo por tentarem replicar o investimento acima sugerido. Quem o fizer, está por sua conta e risco.

Editado pela última vez por Mouro_Emprestado em 16/5/2014 12:56, num total de 1 vez.

- Mensagens: 379

- Registado: 13/9/2013 0:16

Re: Winning the loser's game

Achei interessante esta resposta do Larry Swedroe nos fóruns dos Bogleheads:

DISCLAIMER:

Apenas sei que nada sei.

Ganhos passados não garantem ganhos futuros.

There are also some other issues that have been raised about the use of the CAPE 10. One relates to the issue that far fewer companies pay dividends than was the case in the past. Today, something like 60 percent of U.S. stocks don’t pay dividends, and 40 percent of non-U.S. don’t pay them. In the U.S. that has resulted in the dividend payout ratio on the S&P 500 falling from an average of 52 percent from 1954 through 1995, to just 34 percent from 1995 through 2013. http://philosophicaleconomics.wordpress ... 3/shiller/ At least in theory, higher retention of earnings should result in faster growth of earnings as those retained earnings are reinvested. And that has been the case for this particular period as from 1954 to 1995 real EPS growth rate averaged 1.72 percent, and from 1995 to 2013 it averaged 4.9 percent.

The website Philosophical Economics has a blog on this subject. The author explains that in order to make comparisons between present and past values of the Shiller CAPE, we need to normalize for differences in payout ratios. Making the adjustment between a 52 percent payout ratio (the average of 1954-1995) and a 34 percent payout ratio (the average since 1995) corresponds to around 1 point worth of Shiller CAPE.

The second issue relates to the change in accounting rules regarding writing off goodwill. As Philosophic Economics explains:

“In the old days, GAAP required goodwill amounts to be amortized–deducted from earnings as an incremental non-cash expense–over a forty year period. But in 2001, the standard changed. FAS 142 was introduced, which eliminated the amortization of goodwill entirely. Instead of amortizing the goodwill on their balance sheets over a multi-decade period, companies are now required to annually test it for impairment. In plain english, this means that they have to examine, on an annual basis, any corporate assets that they’ve acquired, and make sure that those assets are still reasonably worth the prices paid. If they conclude that the assets are not worth the prices paid, then they have to write down their goodwill. The requirement for annual impairment testing doesn’t just apply to goodwill, it applies to all intangible assets, and, per FAS 144 (issued a couple months later), all long-lived assets.”

While FASB 142 may be a more accurate method of accounting, it has created an inconsistency in earnings measurements with the present values end up looking more expensive relative to the past than they actually are. And the difference is dramatic. While the CAPE 10 as now measured is about 24.9, adjusting for the accounting change would put it about 4 points lower. http://philosophicaleconomics.wordpress ... 3/shiller/

If we combine the two adjustments of 1 for the lower dividend payout and 4 for the FSB 142 change, the current CAPE 10 at 24.9 which looks way above the mean, doesn’t look so overvalued at a now 19.9. In fact, that’s right about in line with it’s average since 1960. Which begs the questions:

a) Are stocks really overvalued or just highly valued (meaning returns are likely to be lower than historical levels, but that there is no reason to expect a major correction due to RTM)?

b) To what mean should the CAPE ratio revert: The 16.5 mean of the past 113 years, or the 19.6 mean since 1960?

These three points — that over time it’s logical to believe that the equity risk premium for U.S. stocks might have fallen, the accounting change regarding write offs, and the lower payout ratios — provide us with plausible explanations that the CAPE 10’s high level is not signaling a massive overvaluation of U.S. stocks, setting the market up for a major correction as Jeremy Grantham has been forecasting. As a caution, there might be some compelling “stories” on the other side. For example, some have stressed that changing executive compensation practices in the past 20 years have increased the incentives of executives to manage earnings. So at very least one should be cautious about using the Shiller CAPE 10 as a measure of whether is overvalued or undervalued.

DISCLAIMER:

Apenas sei que nada sei.

Ganhos passados não garantem ganhos futuros.

- Mensagens: 379

- Registado: 13/9/2013 0:16

Re: Winning the loser's game

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

101 #ETFFunFacts

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

Mais simples visualização para os perguiçosos

Artigos e estudos: Página repositório dos meus estudos e análises que vou fazendo. Regularmente actualizada. É costume pelo menos mais um estudo por semana. Inclui a análise e acompanhamento das carteiras 4 e 8Fundos.

Portfolio Analyser: Ferramenta para backtests de Fundos e ETFs Europeus

"We don’t need a crystal ball to be successful investors. However, investing as if you have one is almost guaranteed to lead to sub-par results." The Irrelevant Investor

Portfolio Analyser: Ferramenta para backtests de Fundos e ETFs Europeus

"We don’t need a crystal ball to be successful investors. However, investing as if you have one is almost guaranteed to lead to sub-par results." The Irrelevant Investor

Re: Winning the loser's game

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

"Roubado" doutro fórum:

http://www.marketwatch.com/story/warren-buffett-small-investors-have-one-big-advantage-2014-05-01?pagenumber=1

"If you look at the fees that are extracted by Wall Street, on balance, they've gotten quite substantial compared to 25 years ago."

"Investors should own a basket of highly diversified index funds or index ETFs, thus getting the lowest possible cost and the best, most reliable long-term return."

"The single most reliable indicator of a mutual fund's future performance is cost: Low fees equals better returns."

"The fundamental argument made by Jack Bogle, founder of the Vanguard Group: Keep things cheap by design and you cannot help but outperform."

"Vanguard was built to stay cheap by virtue of its ownership, the shareholders of the funds themselves. "The only way anyone can really compete with us on costs is to adopt a mutual ownership structure," Bogle said. "I've been waiting all these years for someone to do it, but no one has."

"Management fees have stayed high, on the order of 1% and even higher. Add in the underlying mutual funds they buy and you could be paying 2.5% or more. Then consider the costs of heavy trading, which are substantial and come right out of your portfolio. It adds up. Just owning the index, meanwhile, costs a tiny fraction of all that while providing a solid, reliable, compounding return. Anyone could do it and everyone should."

http://www.marketwatch.com/story/warren-buffett-small-investors-have-one-big-advantage-2014-05-01?pagenumber=1

- Mensagens: 379

- Registado: 13/9/2013 0:16

Re: Winning the loser's game

You can’t take the same actions as everyone else and expect to outperform.

Esta e outras pérolas podem ser consultadas em Dare to be great e Dare to be great II de Howard Marks (Oaktree Capital).

Esta e outras pérolas podem ser consultadas em Dare to be great e Dare to be great II de Howard Marks (Oaktree Capital).

"Ever tried. Ever failed. No matter. Try again. Fail again. Fail better." - Samuel Becket

Pára de dar crédito fácil ao que lês e ouves, escuta o que o preço está a fazer e olha para o que te rodeia. - O Alquimista

Pára de dar crédito fácil ao que lês e ouves, escuta o que o preço está a fazer e olha para o que te rodeia. - O Alquimista

- Mensagens: 3408

- Registado: 12/3/2014 0:58

Re: Winning the loser's game

O autor não assume responsabilidades por acções tomadas por quem quer que seja nem providencia conselhos de investimento. O autor não faz promessas nem oferece garantias nem sugestões, limita-se a transmitir a sua opinião pessoal. Cada um assume os seus riscos, incluindo os que possam resultar em perdas.

Citações que me assentam bem:

Sucesso é a habilidade de ir de falhanço em falhanço sem perda de entusiasmo – Winston Churchill

Há milhões de maneiras de ganhar dinheiro nos mercados. O problema é que é muito difícil encontrá-las - Jack Schwager

No soy monedita de oro pa caerle bien a todos - Hugo Chávez

O day trader trabalha para se ajustar ao mercado. O mercado trabalha para o trend trader! - Jay Brown / Commodity Research Bureau

Citações que me assentam bem:

Sucesso é a habilidade de ir de falhanço em falhanço sem perda de entusiasmo – Winston Churchill

Há milhões de maneiras de ganhar dinheiro nos mercados. O problema é que é muito difícil encontrá-las - Jack Schwager

No soy monedita de oro pa caerle bien a todos - Hugo Chávez

O day trader trabalha para se ajustar ao mercado. O mercado trabalha para o trend trader! - Jay Brown / Commodity Research Bureau

- Mensagens: 3199

- Registado: 4/3/2008 17:21

- Localização: 16

Re: Winning the loser's game

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

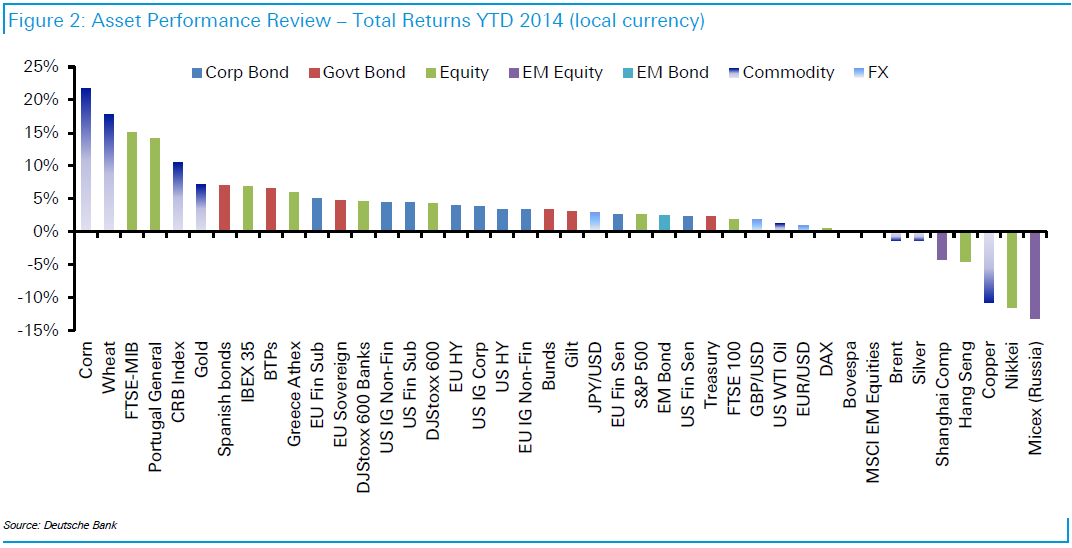

The year so far doesn’t really have any surprises: Russia was the driver at both ends, with Russian stocks doing the worst, and maize (corn) and wheat doing best, thanks to fears of disruption to Ukraine’s harvest. Other notable returns this year have been the result of the eurozone peripheral bond rally, boosting peripheral banks, which in turn led up their local stock markets, Italy’s in particular.

One point of note for returns so far this year: both gilts and bunds have beaten the S&P 500 even in the local currency terms favoured by Deutsche. In common currency terms gilts are way ahead of US equities, as is the Footsie:

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

Boas,

passados 2 anos volto a este topico iniciado pelo LTCM.

hoje posso dizer que sou uma pessoa diferente, nao enriqueci monetariamente, mas este topico, que li algumas vezes, foi o ónus para eu me interessar por investimentos e compreender melhor o mundo q me rodeia. Nao diria que mudou a minha vida, mas quase

Agradeço a todos os que contribuem aqui. Ainda se fala muito de assuntos que já se falavam na altura, dupla tributação, qual o melhor broker, etc. eu cá investi logo que me senti confortável para o fazer, usando o BTP. já me passou pela cabeça mudar, pelas razões já descritas aqui, mas ainda nao o fiz.

resta me agora retomar as leituras.

boas leituras, bons negócios

passados 2 anos volto a este topico iniciado pelo LTCM.

hoje posso dizer que sou uma pessoa diferente, nao enriqueci monetariamente, mas este topico, que li algumas vezes, foi o ónus para eu me interessar por investimentos e compreender melhor o mundo q me rodeia. Nao diria que mudou a minha vida, mas quase

Agradeço a todos os que contribuem aqui. Ainda se fala muito de assuntos que já se falavam na altura, dupla tributação, qual o melhor broker, etc. eu cá investi logo que me senti confortável para o fazer, usando o BTP. já me passou pela cabeça mudar, pelas razões já descritas aqui, mas ainda nao o fiz.

resta me agora retomar as leituras.

boas leituras, bons negócios

- Mensagens: 39

- Registado: 30/3/2011 17:37

- Localização: 14

How to Invest in Emerging Markets

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

The Alternative Investment Management Association (AIMA), the global hedge fund industry body, has published a new educational guide to understanding hedge fund performance.

The guide, ‘Apples and apples: How to better understand hedge fund performance’, says comparing hedge fund performance to the S&P 500 can be an “apples and oranges” comparison and proposes five steps to improve understanding of hedge fund performance.

The study reveals that hedge funds consistently outperform US equities (as measured by the S&P 500), global equities (MSCI World) and global bonds (Barclays Global Aggregate ex-USD Index) on a risk-adjusted basis, a crucial measure for investors. Even during the stock-market rally of recent years, hedge funds performed better on a risk-adjusted basis than the S&P 500 and MSCI World, according to the guide.

To download ‘Apples and apples - click here

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

Fabuloso!  Obrigada!

Obrigada!

O curioso é que se os bancários disserem tudo isto, perdem automaticamente os clientes. Ninguém gosta de dar o seu dinheiro a quem diz que não sabe. As pessoas só confiam em gente que tem todas as certezas do mundo.

O curioso é que se os bancários disserem tudo isto, perdem automaticamente os clientes. Ninguém gosta de dar o seu dinheiro a quem diz que não sabe. As pessoas só confiam em gente que tem todas as certezas do mundo.

Re: Winning the loser's game

Um artigo relativamente extenso mas interessante.

Já partilhei com outros possíveis interessados e um obrigado pela partilha.

Já partilhei com outros possíveis interessados e um obrigado pela partilha.

O autor fornece opinião sem ter em conta os objectivos de investimento de qualquer utilizador privado e não deve ser tido em conta como um aconselhamento de investimento, incluindo, mas não se limitando, às decisões de transacções ou de natureza de gestão de risco. Todas as opiniões apresentadas podem ser alteradas sem aviso prévio.

- Mensagens: 965

- Registado: 25/10/2010 9:57

- Localização: 14

Re: Winning the loser's game

LTCM por acaso não foste tu que escreveste esse artigo, não? Tens escrito muitas coisas semelhantes ao longo dos tempos, o que para mim é de uma visão absolutamente avassaladora. Se nos States este tipo de vozes são uma pequena minoria, em Portugal és tu basicamente

O artigo é muito bom e divertido...manda mais!

O artigo é muito bom e divertido...manda mais!

Re: Winning the loser's game

wow, um post fora do normal, muito interessante essa partilha.

- Mensagens: 499

- Registado: 4/2/2014 15:24

The Ultimate Cheat Sheet For Investing All of Your Money

Remember the Golden Rule: Those who have the gold make the rules.

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

***

"A soberania e o respeito de Portugal impõem que neste lugar se erga um Forte, e isso é obra e serviço dos homens de El-Rei nosso senhor e, como tal, por mais duro, por mais difícil e por mais trabalhoso que isso dê, (...) é serviço de Portugal. E tem que se cumprir."

Re: Winning the loser's game

http://www.bloombergview.com/articles/2 ... cmpid=view

Why Investors Love Hedge Funds

Barry Ritholtz

time iconApr 21, 2014 8:05 AM EDT

Larry Swedroe, research director for BAM Advisor Services LLC, noted earlier this month that total hedge fund assets under management, or AUM, reached $2.63 trillion. This represents a sizable increase, despite fund performance generously described as lackluster.

The increase in assets under management led to some interesting discussions. Lots of readers had e-mailed me with comments on both alpha -- market-beating returns -- and fee generation after last week’s column, ``The Hedge-Fund Manager Dilemma.''

There is much more nuance to the discussion of hedge funds than is widely understood. Today is a good time to review some of the related issues. Let’s see if we can clarify some misunderstandings:

Some hedge funds generate a lot of alpha: Given the underperformance of the industry, why do so many investors want to participate in hedge funds? The most likely answer is the enormous alpha generated by a handful of star managers.

Last week, this came up in an interview with Jim Chanos of Kynikos Associates (I’ll post a link when its released). Chanos started Kynikos in 1985, when there were only a few hundred hedge funds. The concentration of talent -- and alpha generation -- became the stuff of legend.

What has changed is the sheer number of funds and the amount of assets they manage. What hasn’t changed is the reality that the best performers capture a disproportionate amount of alpha. The 9,500 new me-too funds are not, according to the most recent data, keeping up with the top hundred funds. Indeed, they are not even keeping up with their benchmarks.

Beating the market is hard: This is obvious, but let’s give some context. Outperformance is a rare and elusive thing. Consistently outperforming in any given five-year period is harder still. Add in the standard 2 & 20 fee structure (a 2 percent management fee along with 20 percent of any gains) , and managers must overcome the enormous drag on returns. Net of fees and costs, we hunt for the rarest of creatures: Funds that earn their keep. It is no wonder that so few funds can meet that challenge. But the lure of outperformance is only one aspect of their appeal.

Cognitive bias and behavioral driven investing: Meir Statman, a professor at Santa Clara University in California, focuses on the cognitive errors that investors make.

In a 2011 interview, Statman noted that people want more than just returns from their investments. They are also looking for the “status and esteem of hedge funds,” he said. It isn't that different from “the warm glow and virtue of socially responsible funds” that send some investors in that direction. In both instances, performance takes a back seat to the emotional warm fuzzies investors feel. That feeling of belonging to a special club is why some high-net-worth investors are willing to pay up for mediocre performance. It grants them entrée to a sophisticated world they might not otherwise have.

We see this reflected in the mind share hedge funds occupy. Despite managing a relatively small percentage of total investable assets, they capture an unusual amount of media coverage. This may add to the overall mystique.

Selecting emerging managers: Experience has shown us this is an exceedingly difficult task. Beyond our own biases, it simply is a challenge to identify which managers will generate consistently good performance in the future.

The evolution of what happens to successful emerging funds helps to explain why. Some new managers identify unique alpha opportunities. These situations tend to be of modest size, perhaps a few billion dollars worth of market inefficiencies. Often, the emerging funds’ success attracts competitors, and the finite amount of alpha in that area gets fully mined. Very often, we see their success attracting lots of new capital, far in excess of what their niche can support and still generate market-beating returns. Sometimes, their success was simply random, a function of luck, and can't be repeated or duplicated.

Hence, we are faced with a situation where fees are high, outperformance is rare, and our own biases undercut our ability to select managers.

Note that we haven't gotten to the issues of hedging, market timing and stock selection. I plan on visiting these topic in a future discussion.

Quem está ligado:

Trocos por miúdos - blog sobre poupanças e finanças

Trocos por miúdos - blog sobre poupanças e finanças