InterDigital, Inc. (NasdaqGS: IDCC )

Conforme referi, aumentei hoje a exposição na Intedigital. Fica o gráfico publicado à minutos no twitter.

- Anexos

-

- sc.png (113.17 KiB) Visualizado 3799 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Independentemente da conjuntura amanhã no mercado, irei aumentar exposição à IDCC depois de ser oficial a entrada no S&P400

- InterDigital to be added to S&P 400; Quest Software deleted as of 9/28 close

- InterDigital to be added to S&P 400; Quest Software deleted as of 9/28 close

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Deixo a minha ultima análise publicada à minutos sobre a Interdigital, uma das minhas top picks.

" InterDigital, Inc.(NASDAQ:IDCC) has a clear key resistance line just above the 36 level, which it is approaching having gained 43 cents or more than 1.23% today, to 35.51. A move above 36.04 would confirm the breakout, with an initial target of 38.40 and secondary target of 40.68. Stop is at 33.65. The uptrend is definitely intact, awesome medium-term hold. The lows are rising and even the peaks are nudging up and up. Additionally, technical indicators are giving positive signals as the stock trades above the 200-SMA. The RSI is also rising after having found support near its previous lows. I believe the stock can continue its medium-term uptrend and test the $40 levels in the coming weeks. With over a short interest of 6.14 Million shares and average daily volume of only 770K, the short interest ratio is at 7.9, meaning it would take 8 days for all the shares short to be covered. Any type of good news related with a potential patent sale could launch a wicked short squeeze capable of adding a 20%-25% gain to the shares in a matter of minutes as we saw last month. Keep IDCC on the radar like a HAWK lol !! "

" InterDigital, Inc.(NASDAQ:IDCC) has a clear key resistance line just above the 36 level, which it is approaching having gained 43 cents or more than 1.23% today, to 35.51. A move above 36.04 would confirm the breakout, with an initial target of 38.40 and secondary target of 40.68. Stop is at 33.65. The uptrend is definitely intact, awesome medium-term hold. The lows are rising and even the peaks are nudging up and up. Additionally, technical indicators are giving positive signals as the stock trades above the 200-SMA. The RSI is also rising after having found support near its previous lows. I believe the stock can continue its medium-term uptrend and test the $40 levels in the coming weeks. With over a short interest of 6.14 Million shares and average daily volume of only 770K, the short interest ratio is at 7.9, meaning it would take 8 days for all the shares short to be covered. Any type of good news related with a potential patent sale could launch a wicked short squeeze capable of adding a 20%-25% gain to the shares in a matter of minutes as we saw last month. Keep IDCC on the radar like a HAWK lol !! "

- Anexos

-

- sc.png (39.51 KiB) Visualizado 3905 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Interdigital volta a ser indicada como uma potencial candidata a uma aquisição pela Apple.

6 Potential Acquisitions For Apple : http://seekingalpha.com/article/844291- ... urce=yahoo

6 Potential Acquisitions For Apple : http://seekingalpha.com/article/844291- ... urce=yahoo

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

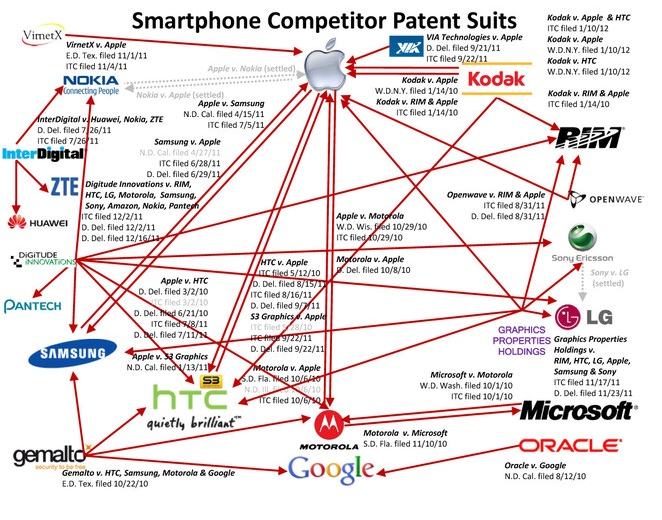

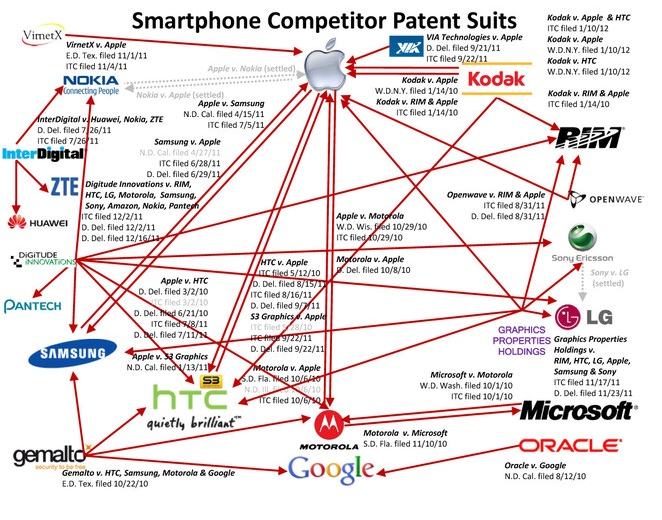

With the explosion in the popularity and significance of smartphones and mobile computing overall, patent litigation in the intellectual property space has become a large business. Companies such as Apple are trying to dominate the market by asserting their patents against their competitors. We designate these companies as "giants". In addition there are companies whose sole purpose is to control, license and enforce patents. These companies at one time may have had inventions of their own or have acquired control of patents. These companies we designate as "trolls".

Here is a graphic description of patent suits from the phonearena.com website in January 2012 shown below:

As you can see, the litigation landscape is already complex and will only continue to grow in complexity as the size of the smartphone/tablet business continues its rapid expansion. With the recent Apple (AAPL) patent win in the "Superbowl of patent litigation" for a cool $1.05 Billion, Samsung (SSNLF.PK) needs some shark repellent much like Google needed when it bought Motorola and when Microsoft (MSFT) bought the AOL patent portfolio and sub-licensed a portion to Facebook (FB). Microsoft has licensed the Apple portfolio and should be happy with its decision. Has Apple become the newest flavor of a patent troll ? Samsung certainly thinks so as you can see from their "internal memo" regarding the loss with Apple and they go as far as saying they will be vindicated.

While some analysts, like Mark Newman at Bersnstein, remain bullish on Samsung, we believe that Samsung should look to acquire a "troll" such as Interdigital (IDCC) which is currently just above $33 per share and well below its 52 week high of $72.83. IDCC recently sold 1700 patents to Intel (INTC) for $375 million in cash. As of the end of 6/30/12 Qtr, IDCC had current assets of $622 million with liabilities excluding long term charges of approximately $200 million, leaving a net cash position of $422 million on a relatively clean balance sheet. Adding the $375 million from the sale to Intel, IDCC's cash before taxes would total $797 million, which is more than half of its current market cap of $1.4 billion. Considering just the cash and the 17,800 patents remaining in IDCC's portfolio, strategic purchasers such as Samsung or Google should view IDCC as a bargain at its current low price.

In fact, IDCC may want to beef up its position in the "troll" space. Recently, Vringo (VRNG) acquired patents from Nokia and attracted Mark Cuban as an investor as well. VRNG has an ongoing patent case with Google and recently won a favorable ruling in a key Markman hearing. Favorable Markman rulings in patent litigation have become much harder since the KSR Supreme Court decision on April 30th 2007 which drastically changed the rules of patent litigation.

Vringo is a pipsqueak in the patent land of giants but could become large quickly with a win against Google or the other co-defendants in the patent lawsuit : AOL (AOL), IAC/InterActive Corp. (IACI), Target Corporation (TGT), and Gannett Co (GCI). An award in this case could certainly be larger than Apple's $1 billion win given the focus of the case on the search/advertising business model which is at the heart of giant Google's revenue stream.

Fonte : http://seekingalpha.com/article/840871- ... urce=yahoo

Here is a graphic description of patent suits from the phonearena.com website in January 2012 shown below:

As you can see, the litigation landscape is already complex and will only continue to grow in complexity as the size of the smartphone/tablet business continues its rapid expansion. With the recent Apple (AAPL) patent win in the "Superbowl of patent litigation" for a cool $1.05 Billion, Samsung (SSNLF.PK) needs some shark repellent much like Google needed when it bought Motorola and when Microsoft (MSFT) bought the AOL patent portfolio and sub-licensed a portion to Facebook (FB). Microsoft has licensed the Apple portfolio and should be happy with its decision. Has Apple become the newest flavor of a patent troll ? Samsung certainly thinks so as you can see from their "internal memo" regarding the loss with Apple and they go as far as saying they will be vindicated.

While some analysts, like Mark Newman at Bersnstein, remain bullish on Samsung, we believe that Samsung should look to acquire a "troll" such as Interdigital (IDCC) which is currently just above $33 per share and well below its 52 week high of $72.83. IDCC recently sold 1700 patents to Intel (INTC) for $375 million in cash. As of the end of 6/30/12 Qtr, IDCC had current assets of $622 million with liabilities excluding long term charges of approximately $200 million, leaving a net cash position of $422 million on a relatively clean balance sheet. Adding the $375 million from the sale to Intel, IDCC's cash before taxes would total $797 million, which is more than half of its current market cap of $1.4 billion. Considering just the cash and the 17,800 patents remaining in IDCC's portfolio, strategic purchasers such as Samsung or Google should view IDCC as a bargain at its current low price.

In fact, IDCC may want to beef up its position in the "troll" space. Recently, Vringo (VRNG) acquired patents from Nokia and attracted Mark Cuban as an investor as well. VRNG has an ongoing patent case with Google and recently won a favorable ruling in a key Markman hearing. Favorable Markman rulings in patent litigation have become much harder since the KSR Supreme Court decision on April 30th 2007 which drastically changed the rules of patent litigation.

Vringo is a pipsqueak in the patent land of giants but could become large quickly with a win against Google or the other co-defendants in the patent lawsuit : AOL (AOL), IAC/InterActive Corp. (IACI), Target Corporation (TGT), and Gannett Co (GCI). An award in this case could certainly be larger than Apple's $1 billion win given the focus of the case on the search/advertising business model which is at the heart of giant Google's revenue stream.

Fonte : http://seekingalpha.com/article/840871- ... urce=yahoo

- Anexos

-

- sc.png (31.61 KiB) Visualizado 4009 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Entrevista : http://www.thestreet.com/_yahoo/video/1 ... ite=NA&s=1

Neste momento a IDCC tem um programa de recompra de acções em andamento que pode ir até aos 200 Milhoes de dólares.....

3 Small Cap Tech Stocks With Enormous Upside Potential :http://seekingalpha.com/article/840281-3-small-cap-tech-stocks-with-enormous-upside-potential?source=yahoo

Neste momento a IDCC tem um programa de recompra de acções em andamento que pode ir até aos 200 Milhoes de dólares.....

3 Small Cap Tech Stocks With Enormous Upside Potential :http://seekingalpha.com/article/840281-3-small-cap-tech-stocks-with-enormous-upside-potential?source=yahoo

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

InterDigital CEO Says Apple-Samsung Case Providing Boost

Bloomberg : http://www.bloomberg.com/news/2012-08-2 ... boost.html

Bloomberg : http://www.bloomberg.com/news/2012-08-2 ... boost.html

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Deixo o gráfico que acabei de colocar no twitter, acima dos 34.74 temos + $1 a $2 de subida...

- Anexos

-

- sc.png (91.12 KiB) Visualizado 4146 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Está demonstrar força hoje, contrariamente ou dia de ontem, estando a trasancionar mesmo junto à sua MM200. A sua quebra e consequente fecho acima, será um forte sinal Bull. A posição curta ronda os 6 Milhoes de titulos ou seja quase 10 dias para cobrir as posições face aos volumes actuais.

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

A linha dos 200 periodos voltou hoje a fazer moça e a demonstrar ser um osso duro de roer. Pelo que, será prudente esperar-se pela sua ruptura para um aumento das posições longas. Os MM's trabalharam bem hoje para evitar um short-squeeze no titulo. Conseguiram abanar com os mãos fracas e colocar um resfriamento na euforia inicial. Depois das noticias da Apple, contava mesmo com um fecho hoje superior à MM200, mas como não acabou por suceder, não aumentei exposição mas continuo com 1 forte posição longa na IDCC.

- Anexos

-

- sc.png (29.66 KiB) Visualizado 4249 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Deixo-vos o que publiquei e desculpem estar em Inglês, mas a imagem vale mil palavras... Depois das noticias de ontem à Noite da Apple a corrida á IDCC vai ser interessante na Segunda-feira...

" InterDigital, Inc.(NASDAQ:IDCC) has finally started to rally and broke out of the consolidation that the stock had been stuck under for the last 2 weeks. It has breached two important levels at 33.08 and 33.33 quite convincingly. I see the next resistance in the 34.20-34.35 area. A move above this area would be viewed very bullish and could cause a huge short squeeze. There are some reasons to start taking an active look at this stock as I have been mentioned several times in my blog posts.

- The volume chart from OBV has been on an upside indicating strength.

- The MACD is above 0 showing positive momentum but displaying first signs of divergence between column bars and the trend line.

- RSI is on a comfortable zone.

- Trading above both 13 & 50 day moving averages moving upwards

- It has been making higher lows since June.

- 13.8% short or 6.1 M & might see a good squeeze above its 200-SMA

- High short ratio 11.10

From a technical standpoint the potential for further upside looks far more attractive on purely relative terms. Honestly, I like what I am seeing...Additionally, the company continues being mentioned in the news regularly as a strong potential buyout candidate. This is definitely a stock to watch next week."

" InterDigital, Inc.(NASDAQ:IDCC) has finally started to rally and broke out of the consolidation that the stock had been stuck under for the last 2 weeks. It has breached two important levels at 33.08 and 33.33 quite convincingly. I see the next resistance in the 34.20-34.35 area. A move above this area would be viewed very bullish and could cause a huge short squeeze. There are some reasons to start taking an active look at this stock as I have been mentioned several times in my blog posts.

- The volume chart from OBV has been on an upside indicating strength.

- The MACD is above 0 showing positive momentum but displaying first signs of divergence between column bars and the trend line.

- RSI is on a comfortable zone.

- Trading above both 13 & 50 day moving averages moving upwards

- It has been making higher lows since June.

- 13.8% short or 6.1 M & might see a good squeeze above its 200-SMA

- High short ratio 11.10

From a technical standpoint the potential for further upside looks far more attractive on purely relative terms. Honestly, I like what I am seeing...Additionally, the company continues being mentioned in the news regularly as a strong potential buyout candidate. This is definitely a stock to watch next week."

- Anexos

-

- sc.png (40.15 KiB) Visualizado 4314 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Continuo com posições longas na IDCC reforçadas após o anuncio da vitória no CAFC sobre a Nokia.... A guerra de patentes continua bastante activa e com perspectivas boas para os seus detentores.

http://www.fool.com/investing/general/2 ... BzwmaCs_mA

http://wirelessledger.com/Mpartners_mor ... 12_8_2.pdf

http://www.fool.com/investing/general/2 ... BzwmaCs_mA

http://wirelessledger.com/Mpartners_mor ... 12_8_2.pdf

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

+14% sweet  Foi destaque ontem no blog e hoje no twitter

Foi destaque ontem no blog e hoje no twitter

BLOOMBERG: InterDigital Wins U.S. Appeal in Patent Fight With Nokia

InterDigital Wins U.S. Appeal in Patent Fight With Nokia

By Susan Decker - Aug 1, 2012 8:30 AM PT

InterDigital Inc. (IDCC) won an appeals court ruling reviving its effort to force Nokia Oyj (NOK) to pay patent royalties on the third generation of mobile-phone technology. InterDigital soared as much as 25 percent on the decision.

The U.S. Court of Appeals for the Federal Circuit today overturned a U.S. International Trade Commission decision that cleared Nokia of claims it infringed InterDigital patents, and sent the case back to the agency for further review. The decision was posted on the court’s website.

The commission “erred in construing certain critical claim terms in both patents,” the appeals court said. The patents in the case, first filed in 2007, cover power control and high- speed data transmission, InterDigital contends.

InterDigital has said it asked the ITC to block imports of Nokia (NOK1V)’s 3G phones because the Espoo, Finland-based company refuses to pay patent royalties on networks that allow mobile- phone users to hold videoconferences, download music and browse the Internet. Patent royalties accounted for almost all of the $301.7 million in revenue InterDigital reported last year.

InterDigital rose $4.86, or 18 percent, to $32.16 at 11:11 a.m. and traded for as much as $34.10 in Nasdaq Stock Market trading.

Commission Decision

In the ITC case, the trade commission sided with Nokia, saying the patents weren’t infringed. Nokia, whose sales have declined amid smartphone competition from companies including Apple Inc. (AAPL), had also claimed the InterDigital patents were invalid.

InterDigital filed a second complaint at the ITC against Nokia, as well as ZTE Corp. (000063) and Huawei Technologies Co., accusing the Chinese phone-equipment makers of infringing patents related to 3G wireless technology. A hearing in that case is scheduled for October in Washington.

InterDigital, based in King of Prussia, Pennsylvania, said in its annual report that it received royalties from more than half of all 3G mobile devices sold last year, including ones from Samsung Electronics Co. (005930), Apple, Research In Motion and HTC Corp. (2498)

Nokia had a license with InterDigital for second-generation and some third-generation technology that expired in 2006. Nokia paid $253 million in a settlement reached in 2006. The companies were unable to reach a new agreement, InterDigital has said.

The case is InterDigital Communications v. ITC, 2010-1093, U.S. Court of Appeals for the Federal Circuit (Washington). The ITC case is In the Matter of Certain 3G Mobile Handsets and components thereof, 337-613, U.S. International Trade Commission (Washington).

The pending ITC case is In the Matter of Wireless Devices with 3G Capabilities, 337-800, ITC in Washington.

http://www.bloomberg.com/news/2012-08-0 ... ia-1-.html

BLOOMBERG: InterDigital Wins U.S. Appeal in Patent Fight With Nokia

InterDigital Wins U.S. Appeal in Patent Fight With Nokia

By Susan Decker - Aug 1, 2012 8:30 AM PT

InterDigital Inc. (IDCC) won an appeals court ruling reviving its effort to force Nokia Oyj (NOK) to pay patent royalties on the third generation of mobile-phone technology. InterDigital soared as much as 25 percent on the decision.

The U.S. Court of Appeals for the Federal Circuit today overturned a U.S. International Trade Commission decision that cleared Nokia of claims it infringed InterDigital patents, and sent the case back to the agency for further review. The decision was posted on the court’s website.

The commission “erred in construing certain critical claim terms in both patents,” the appeals court said. The patents in the case, first filed in 2007, cover power control and high- speed data transmission, InterDigital contends.

InterDigital has said it asked the ITC to block imports of Nokia (NOK1V)’s 3G phones because the Espoo, Finland-based company refuses to pay patent royalties on networks that allow mobile- phone users to hold videoconferences, download music and browse the Internet. Patent royalties accounted for almost all of the $301.7 million in revenue InterDigital reported last year.

InterDigital rose $4.86, or 18 percent, to $32.16 at 11:11 a.m. and traded for as much as $34.10 in Nasdaq Stock Market trading.

Commission Decision

In the ITC case, the trade commission sided with Nokia, saying the patents weren’t infringed. Nokia, whose sales have declined amid smartphone competition from companies including Apple Inc. (AAPL), had also claimed the InterDigital patents were invalid.

InterDigital filed a second complaint at the ITC against Nokia, as well as ZTE Corp. (000063) and Huawei Technologies Co., accusing the Chinese phone-equipment makers of infringing patents related to 3G wireless technology. A hearing in that case is scheduled for October in Washington.

InterDigital, based in King of Prussia, Pennsylvania, said in its annual report that it received royalties from more than half of all 3G mobile devices sold last year, including ones from Samsung Electronics Co. (005930), Apple, Research In Motion and HTC Corp. (2498)

Nokia had a license with InterDigital for second-generation and some third-generation technology that expired in 2006. Nokia paid $253 million in a settlement reached in 2006. The companies were unable to reach a new agreement, InterDigital has said.

The case is InterDigital Communications v. ITC, 2010-1093, U.S. Court of Appeals for the Federal Circuit (Washington). The ITC case is In the Matter of Certain 3G Mobile Handsets and components thereof, 337-613, U.S. International Trade Commission (Washington).

The pending ITC case is In the Matter of Wireless Devices with 3G Capabilities, 337-800, ITC in Washington.

http://www.bloomberg.com/news/2012-08-0 ... ia-1-.html

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Amazon Said to Plan Smartphone to Vie With Apple

Amazon.com Inc. (AMZN) is developing a smartphone that would vie with Apple Inc. (AAPL)’s iPhone and handheld devices that run Google Inc. (GOOG)’s Android operating system, two people with knowledge of the matter said.

Foxconn International Holdings Ltd. (2038), the Chinese mobile- phone maker, is working with Amazon on the device, said one of the people, who asked not to be identified because the plans are private. Amazon is seeking to complement the smartphone strategy by acquiring patents that cover wireless technology and would help it defend against allegations of infringement, other people with knowledge of the matter said.

A smartphone would give Amazon a wider range of low-priced hardware devices that bolster its strategy of making money from digital books, songs and movies. It would help Chief Executive Officer Jeff Bezos -- who made a foray into tablets with the Kindle Fire -- carve out a slice of the market for advanced wireless handsets. Manufacturers led by Samsung Electronics Co. and Apple shipped 398.4 million smartphones in the first quarter, according to researcher IDC.

Drew Herdener, a spokesman for Amazon, declined to comment.

Mark Mahaney, an analyst at Citigroup Inc., said in November that Amazon is planning to release a smartphone.

Seattle-based Amazon considered buying wireless patents from InterDigital Inc. before the King of Prussia, Pennsylvania- based company said in June that it will sell the assets to Intel Corp. for $375 million, two people said. Amazon is taking pitches and setting up briefings with other sellers, the people said.

Patent Protection

Foxconn rose as much as 4.5 percent, the most on an intraday basis since June 18, and traded at HK$2.77 as of 1:02 p.m. in Hong Kong, compared with a 0.5 percent drop in the Hang Seng index.

Amazon beefed up its patent prowess recently by hiring Matt Gordon, formerly senior director of acquisitions at Intellectual Ventures Management LLC, the company that was founded by former Microsoft Corp. Chief Technology Officer Nathan Myhrvold and owns more than 35,000 intellectual property assets. Gordon will be general manager for patent acquisitions and investments at Amazon, according to his profile on LinkedIn.

Adding patents would help Amazon protect itself against lawsuits alleging illegal use of technology. Amazon has been involved in five patent-related cases this year, and 20 cases last year, according to data compiled by Bloomberg.

Demand for mobile patents has increased, as shown recently by Google’s $12.5 billion acquisition of Motorola Mobility Holdings Inc. and its thousands of patents, which closed this year.

Source : http://www.bloomberg.com/news/2012-07-0 ... cmpid=yhoo

Mais uns à procura de Patentes

Amazon.com Inc. (AMZN) is developing a smartphone that would vie with Apple Inc. (AAPL)’s iPhone and handheld devices that run Google Inc. (GOOG)’s Android operating system, two people with knowledge of the matter said.

Foxconn International Holdings Ltd. (2038), the Chinese mobile- phone maker, is working with Amazon on the device, said one of the people, who asked not to be identified because the plans are private. Amazon is seeking to complement the smartphone strategy by acquiring patents that cover wireless technology and would help it defend against allegations of infringement, other people with knowledge of the matter said.

A smartphone would give Amazon a wider range of low-priced hardware devices that bolster its strategy of making money from digital books, songs and movies. It would help Chief Executive Officer Jeff Bezos -- who made a foray into tablets with the Kindle Fire -- carve out a slice of the market for advanced wireless handsets. Manufacturers led by Samsung Electronics Co. and Apple shipped 398.4 million smartphones in the first quarter, according to researcher IDC.

Drew Herdener, a spokesman for Amazon, declined to comment.

Mark Mahaney, an analyst at Citigroup Inc., said in November that Amazon is planning to release a smartphone.

Seattle-based Amazon considered buying wireless patents from InterDigital Inc. before the King of Prussia, Pennsylvania- based company said in June that it will sell the assets to Intel Corp. for $375 million, two people said. Amazon is taking pitches and setting up briefings with other sellers, the people said.

Patent Protection

Foxconn rose as much as 4.5 percent, the most on an intraday basis since June 18, and traded at HK$2.77 as of 1:02 p.m. in Hong Kong, compared with a 0.5 percent drop in the Hang Seng index.

Amazon beefed up its patent prowess recently by hiring Matt Gordon, formerly senior director of acquisitions at Intellectual Ventures Management LLC, the company that was founded by former Microsoft Corp. Chief Technology Officer Nathan Myhrvold and owns more than 35,000 intellectual property assets. Gordon will be general manager for patent acquisitions and investments at Amazon, according to his profile on LinkedIn.

Adding patents would help Amazon protect itself against lawsuits alleging illegal use of technology. Amazon has been involved in five patent-related cases this year, and 20 cases last year, according to data compiled by Bloomberg.

Demand for mobile patents has increased, as shown recently by Google’s $12.5 billion acquisition of Motorola Mobility Holdings Inc. and its thousands of patents, which closed this year.

Source : http://www.bloomberg.com/news/2012-07-0 ... cmpid=yhoo

Mais uns à procura de Patentes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Jesusdabolsa Escreveu:o que achas da acção agora ac?

Fica a minha análise publicada ontem no blog.

"InterDigital, Inc.(NASDAQ:IDCC) also look great, it just broke a bull flag to the upside. $30.28 is an important resistance, that once broken, will set off a huge run up in stock, the 1st target would be $35 which is the high of April."

- Anexos

-

- sc.png (28.75 KiB) Visualizado 4628 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

InterDigital (NASDAQ:IDCC) is once again exploring a sale of its patents, two industry sources briefed on the matter told dealReporter.

The Pennsylvania-based wireless technology company announced in January it had concluded a strategic review that began in July 2011. The process stalled because of the gap between buyer and seller’s price expectations, this news service previously reported.

For the current talks, InterDigital has split its patent portfolio into separate bundles to appeal to more buyers, the first source said. As in the strategic review, Evercore is acting as InterDigital’s financial advisor, said one of the sources. This source added the current process is late into the first round of bidding.

A person close to InterDigital said the focus is on the sale of bundles of patents, but if a buyer were to emerge for the entire company, the board would consider such an offer.

Evercore did not return a request for comment.

The two sources said InterDigital appeared to be less ambitious on valuation this time around. Its expectations last year for the whole company were buoyed by the high price paid for Nortel’s intellectual property assets.

An industry banker said he expected the portfolio would attract serious bids because of the interest among large technology companies -- such as Google (NASDAQ: GOOG), Samsung (NASDAQ: SSNLF), and Apple (NASDAQ: AAPL) -- seeking to protect their businesses from patent litigation.

InterDigital’s market capitalization currently stands at USD 1.44bn.

Fonte : Financial Times http://www.ft.com/cms/s/2/88f9ec6e-8e56 ... z1t04wo2gH

The Pennsylvania-based wireless technology company announced in January it had concluded a strategic review that began in July 2011. The process stalled because of the gap between buyer and seller’s price expectations, this news service previously reported.

For the current talks, InterDigital has split its patent portfolio into separate bundles to appeal to more buyers, the first source said. As in the strategic review, Evercore is acting as InterDigital’s financial advisor, said one of the sources. This source added the current process is late into the first round of bidding.

A person close to InterDigital said the focus is on the sale of bundles of patents, but if a buyer were to emerge for the entire company, the board would consider such an offer.

Evercore did not return a request for comment.

The two sources said InterDigital appeared to be less ambitious on valuation this time around. Its expectations last year for the whole company were buoyed by the high price paid for Nortel’s intellectual property assets.

An industry banker said he expected the portfolio would attract serious bids because of the interest among large technology companies -- such as Google (NASDAQ: GOOG), Samsung (NASDAQ: SSNLF), and Apple (NASDAQ: AAPL) -- seeking to protect their businesses from patent litigation.

InterDigital’s market capitalization currently stands at USD 1.44bn.

Fonte : Financial Times http://www.ft.com/cms/s/2/88f9ec6e-8e56 ... z1t04wo2gH

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Um gap pra fechar...

- Anexos

-

- sc.jpg (90.5 KiB) Visualizado 4843 vezes

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Insiders compraram ontem massivamente um numero elevado de acções.

Fonte : http://www.form4oracle.com/company/inte ... c?id=12109

Fonte : http://www.form4oracle.com/company/inte ... c?id=12109

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

AC Investor Blog Escreveu:Ela há-de voltar ao brilho novamente, é uma questão de tempo até arrefecer este impacto.

Também acredito.

Em termos fundamentais, pode-se dizer que a IDCC, tem tudo no sitio, há excepção do PER e do PSR.

A IDCC tem um Price Earnings Ratio (normalmente designado por P/E ou PER) alto. Este, é um dos indicadores mais utilizado pelos investidores para analisar o valor de uma ação. Representa a relação entre o seu preço e os lucros da empresa. Quanto mais elevado for o seu valor, mais cara deverá estar a acção (e, como tal, menos atractiva) e vice-versa. Um PER de 10 é baixo e um de 20 é alto.

O PER, por si só, diz muito pouco sobre o valor de uma ação. Ele só ganha relevância quando colocado em comparação com o de outras empresas que devem estar no mesmo sector e em condições de mercado semelhantes, no entanto, também temos de equacionar o motivo de o PER da IDCC ser alto. Julgo que será pela existência de um enorme potencial de mercado como tem vindo a ser referido em posts anteriores.

O PSR também está um pouco alto..., mas temos que lhe dar o beneficio da dúvida.

Espero ter ajudado.

Bons negócios

Exacto Luka,

Ela há-de voltar ao brilho novamente, é uma questão de tempo até arrefecer este impacto.

Aconselho uma leitura deste artigo : http://www.minyanville.com/buzz/buzzale ... from=yahoo

Ela há-de voltar ao brilho novamente, é uma questão de tempo até arrefecer este impacto.

Aconselho uma leitura deste artigo : http://www.minyanville.com/buzz/buzzale ... from=yahoo

AC Investor Blog

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

www.ac-investor.blogspot.com -

Análises Técnicas de activos cotados em Wall Street. Os artigos do AC Investor podem também ser encontrados diariamente nos portais financeiros, Daily Markets, Benzinga, Minyanville, Solar Feeds e Wall Street Pit, sendo editor e contribuidor. Segue-me também no Twitter : http://twitter.com/#!/ACInvestorBlog e subscreve a minha newsletter.

Effectivamente como disse o AC os resultados foram bastante bons... mas o valor especulativo (compra por terceiros) sobrepunha-se aos fundamentais.

Penso que é um titulo a seguir nos proximos dias quando o 'momentum ' de queda acalmar...

>> como é obvio com uma valorisaçao mais baixa pode se tornar mais atractiva para ser comprada por terceiros ...

Penso que é um titulo a seguir nos proximos dias quando o 'momentum ' de queda acalmar...

>> como é obvio com uma valorisaçao mais baixa pode se tornar mais atractiva para ser comprada por terceiros ...

... if you feel like doubling up a profitable position, slam your finger in a drawer until the feeling goes away !